charles

FRAUD

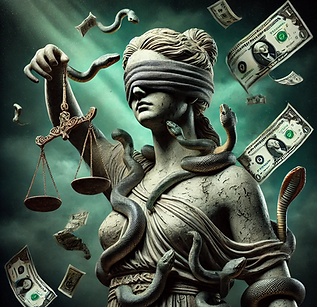

Expose Truth.Fight Injustice.Demand Action.

Spread the word...

CHARLES FRAUD IS HERE!

THE CHARLES FRAUD MISSION

Charles Fraud is dedicated to spreading the word regarding my personal experience, but that is just the starting point. Another goal is to help others--immediately, to find fraud in their own account records. If we can prove these errors are widespread in retail investors' accounts, as I suspect they are, this would pave the way for some meaningful action far beyond that which I or any single individual could achieve alone.

From Charles Fraud's perspective, the problem transcends beyond any single corporation or industry. When powerful entities evade accountability for known wrongdoing, trust in critical institutions erodes. Evidently, we've already started traversing down this wayward course, but awareness can set the course for meaningful change.

Charles Fraud aspires to be a leading forum for exposing schemes and abuses of all sorts.

Technology promises boundless progress, yet its intricate frameworks are ripe for abuse. Innovation and exploitation are related. There is great potential, but also great risk. It's a package deal, same as mastery of nuclear energy, and before that, of fire. Here, it applies to data management, application development, and computing, generally. Irresponsible utilization risks destruction at scales previously unimaginable. It's time to wake up and take notice, especially regarding the abuses here, that--several years ago--should have been acknowledged, and action taken--so to potently deter future misconduct.

Charles Fraud is here.

.

WHAT HAPPENED?

For years, Schwab insisted my allegations of fraud were baseless.

Now, it has been revealed: they secretly blamed me.

"Behind closed doors... they added me to fraud hotlists reserved for money launderers and terrorist financiers"

Charles Schwab & Co., Inc. added me to fraud "Hotlists"---secretly--while arguing in court (and ever since then) that no fraud or erroneous accounting occurred in my Schwab brokerage account. But my account was defrauded by a sophisticated scheme, perpetrated by an enterprise with insider access to Schwab and TD Ameritrade's systems. When I notified Schwab that funds were missing (and of other errors and anomalies concerning my account and their mobile app), they denied all wrongdoing and refused to acknowledge any irregularities. Behind closed doors, however, they added me to fraud hotlists reserved for money launderers and terrorist financiers: They were well aware that fraud occurred, and they blamed me to avoid responsibility.

Money Laundering Through my "Closed" Account

Schwab also suppressed evidence of money laundering through my "closed" account--months after my access was shut off. Previously, I'd claimed that (1) unauthorized transactions occurred that (2) involved funds that were unaccounted for (i.e., made to "disappear"), and which (3) were laundered through the Futures account. These allegations, though strongly supported by evidence, relied on analyses of myriad discrepancies amongst the various records. And even then, it could only be inferred that the Futures Account was being utilized as a pass-through to facilitate the theft of funds (that had been concealed by the erroneous accounting). But now, money laundering is directly evidenced by a single document showing offsetting cash transfers in my "closed" Schwab Futures account.

The perpetrators of this scheme sought to escape accountability altogether... and so far, they've succeeded. Rather than acknowledging their own shortcomings and taking corrective actions, Schwab aggressively denied all wrongdoing. They strategically attacked my credibility and reputation rather than contesting the merits of the alleged errors. Whether negligently or maliciously, they aligned themselves with the illicit enterprise that abused their systems to target my account (and likely other clients' accounts, too).

"like a never-ending episode of Black Mirror or the Twilight Zone...

Only this is real"

Schwab still denies that any evidence exists indicative of fraudulent activity, or otherwise that any errors exist in the account records. Their disparaging characterizations of my allegations and of me, personally, have been rubberstamped and validated as the truth by the authorities. The consequences of this injustice encroach on nearly every corner of my life—like a never-ending episode of Black Mirror or The Twilight Zone... Only this is real. My reputation and credibility have been ruined, but this story is not over.

I wanted to move on with my life and focus my efforts on other endeavors, but I have no such liberty. I was committed to resolving this ordeal at FINRA arbitration, but the evidence described above was stricken from the record at Schwab's behest. They made certain I would never have a fair opportunity to have my claims vindicated, regardless of the venue.

_edited.jpg)

In September 2023, I filed a petition in Nebraska federal court to vacate the arbitration award. The matter has remained pending for two years with no ruling. On November 6, 2025, I filed a motion seeking to expedite resolution.

See the Pending Litigation page to access the court filings for case 8:23-cv-00407:

Pitlor vs. TD Ameritrade, Inc. and Charles Schwab & Co., Inc. (Nebraska)

THE SCHWAB - TD AMERITRADE CONSPIRACY

"Exhibit 'S'", included with the November 6 filing, presents an overview of the evidence that my Android smartphone was compromised by a multifaceted exploit chain to sabotage my Schwab account, and moreover that TD Ameritrade's app was integrally involved (in 2018 -- while the companies were supposedly still competitors).

WHAT HAPPENS NOW?

I plan to file a new lawsuit based on the suppressed evidence that was wrongly excluded from the arbitration. The scope of future claims ultimately depends the court's ruling in the currently pending case, 8:23-cv-00407 (particularly with respect to res judicata -- claim and issue preclusion).

There are several compelling aspects of this saga that seem literally "unbelievable" but are nevertheless well documented. If you have an established platform and are interested in having a conversation, please get in touch.

Likewise, if you have had a similar experience in your brokerage accounts (or other sophisticated schemes to defraud unsuspecting consumers), and you have some evidence to back it up... I'd love to hear about it.

In the meantime, I intend to continue building this site and expanding its reach. I continue work on my pet project, the "Dissy Awards" (see below), and am hoping that will bring people back to this website. And of course, I intend for this website to evolve into a forum for exposing corruption, generally, without limitations, and with facts and analysis that will raise the level of the discourse (that seems to have slipped considerably in recent years). Please submit tips and suggestions. Your input would be sincerely and genuinely appreciated.

Read more ABOUT CHARLES FRAUD

Has fraud targeted your brokerage account?

Recordkeeping errors can be rather subtle, but once you know what to look for, it's quite easy to check your own records to see your accounts have been targeted by similar schemes.

The Dissy AWARDS

Click here or on the picture above to visit the Dissy Awards' Archive

Charles Fraud presents the "Dissy Awards" to raise awareness regarding FINRA disciplinary actions--and particularly to highlight their shortcomings and inadequacies.

Click here or on the p

“Inaccurate or untimely … reporting can negatively affect the regulatory audit trail … as well as FINRA’s ability to accurately reconstruct market events.” Source: 2023 Report on FINRA’s Examination and Risk Monitoring Program

-

Frequently, large volumes of transactions are acknowledged to have been misreported or unreported to the regulatory agencies. In some cases, millions, and even billions of transactions have been misreported.

-

Deeper dives into the impacts of the errors often does not occur, nor is able to in many instances. When trades are misreported—or not reported at all—regulators can’t see what really happened.

2023 FINRA DISCIPLINARY ACTION REVEALED CRITICAL INSIGHTS INTO SCHWAB'S ERRONEOUS ACCOUNTING AND "CODING ERRORS"

-

Recordkeeping mistakes aren’t proof of wrongdoing. Yet they can mask it by creating blind spots in the official record. Hence the critical importance of the Barclays’ disciplinary action (FINRA A.W.C. No. 2019061076001):

-

Barclays acknowledged that the same type of reporting inaccuracies identified in my Schwab records indeed corresponded to "positions" (i.e., transactions) that failed to be reported.

-

Moreover, they attributed the issue to "coding errors." Crashes of the Schwab app revealed that "coding errors" indeed occurred on the same days as misreported/unreported transactions.

-

Schwab's "coding errors" reveal a sophisticated exploit chain that was executed to compromise my Schwab account and my Android smartphone--and that TD Ameritrade played a central role. See Exhibit 'S' from the latest filing for more details.

CONTACT CHARLES FRAUD

email: CF@charlesfraud.com

Follow on social media @CharlesFraud0

Challenge "CharlesFraud" at Chess on the Chess.com app.

Join the Cause

Charles Fraud will graciously accept your donation

Send BTC: 36ioxJtMZzpzw33YuZusBCVsA81mW6dHSx

Venmo: @charlesfraud

Thank you for visiting CharlesFraud.com. Hopefully, this is just the beginning of something much bigger. If you like what you see here and are interested in supporting the cause, please donate!

Perhaps you are tired of donating to charities that spend the money congratulating themselves for their good work, or otherwise to causes that mean well but spend big to support endeavors that do not yield significant action...

I developed all the material on the site (and then had to learn how to make this website). Imagine the possibilities if I had the resources to hire a team.

My dream would be to fully devote myself to the Charles Fraud mission and expand my focus to other schemes, fraud, and corruption - not merely limited to my experience with Schwab and TD Ameritrade. There's certainly no shortage of fraudulent schemes and corruption in other areas and industries, both within and beyond the financial world, that needs to be put in check.

Any donation would be genuinely appreciated, and I can guarantee you that it will serve a righteous purpose. But let's not lose focus... The mission here is to raise awareness, and that needn't cost a penny. So, I'll humbly request one more time:

Spread the word... Charles Fraud is here.

All the best,

"Charles Fraud"

Send BTC: 36ioxJtMZzpzw33YuZusBCVsA81mW6dHSx

.jpg)